News & Blog

News stories from the Chamber and related news are listed in the table below

PAYE and how to avoid PAYE penalties.

22nd September 2023

Senior Tax Manager, Keith Hunter, discusses the main areas of risk to employers surrounding PAYE and how to avoid PAYE penalties.

Avoiding the pain of PAYE penalties

As the famous quote by Greek philosopher Heraclitus goes “Change is the only constant in life.” It certainly feels like that when running a business. The ever-changing landscape of taxation and associated regulations that need to be navigated means there are many boxes to tick to remain compliant.

Business owners often focus on the road ahead, making plans to improve their products and services, expand into new markets, etc. However, it sometimes pays to look back. Reviewing certain areas of your business can not only help you avoid costly mistakes, it can also identify potential savings.

Employment taxes are major contributor to the Treasury

HMRC are under increasing pressure to expand the resources given to enforcement activities in order to reduce the amount owed in unpaid tax (which stood at an estimated £42Bn in June 2022).

Given that employment taxes are the largest annual contributor to the Treasury it is no surprise that HMRC are likely to focus their attention there.

Historically, employers could expect a PAYE review from HMRC every 6 years or so. A more intelligence/risk-based approach is currently adopted by HMRC. As more business owners struggle to attract and retain the best talent, enhanced benefits packages and other incentives have become more commonplace. These can often be complex to administer and report accurately, and result in costly errors.

Main areas of risk

An overview of current hot topics and areas of risk where HMRC will focus include:

Status of workers

HMRC will want to review any off-payroll engagements and compliance with intermediaries (IR35) legislation.

Coronavirus Job Retention Scheme (CJRS)

Given the multiple legislative variations over the claim period, HMRC are of the view significant overclaims may have been made.

Salary Sacrifice

Incomplete or incorrect systems in this respect remain one of the main reasons for settlements arising from HMRC PAYE compliance checks.

Company vehicles

Mistakes remain common in connection with categorisation of pool cars and commercial vehicles for benefit-in-kind purposes (particularly in relation to crew-cab or ‘multi-purpose’ vehicles).

The provision of fuel is another area where there are compliance issues.

Staff entertaining and gifts

HMRC would look to confirm the appropriate exemptions have been applied correctly and any expenditure not covered returned to HMRC.

Benefits and expenses

HMRC will review expense claims, mileage records and internal processes to check compliance.

Termination packages

To review the treatment of notice pay and the application of tax and NIC exemptions.

Payroll Administration

Whilst unlikely to be the source of any major discrepancies from a tax or NIC perspective, a high-level review of procedures will be undertaken to evaluate the effectiveness of the payroll function, including pensions.

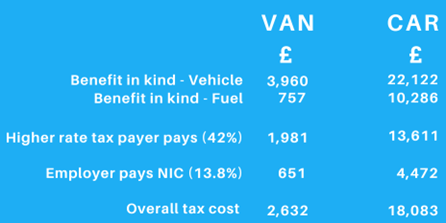

Picking up on an area above in terms of potential exposure, taking a vehicle recently classified by the courts as a car for benefit-in-kind purposes, a modified VW Kombi T5.

Picking up on an area above in terms of potential exposure, taking a vehicle recently classified by the courts as a car for benefit-in-kind purposes, a modified VW Kombi T5.

HMRC are able to go back 6 years and, if the vehicle has been incorrectly classified for this period, an additional liability of around £70,000 can arise for the employee (not counting interest and penalties) and the employer would have additional exposure of £23,000. Were the employer to meet the employee’s liability, the value would ‘gross-up’ which would create a charge of around £137,000 for one vehicle over 6 tax years!

How can businesses manage their PAYE risk?

Have you been targeted for a HMRC compliance visit? Thinking of selling your business? Undertaking a due diligence project or just need peace of mind? There are many reasons a business may wish to review their performance in terms of compliance so they can remedy any issues.

An examination of a business’s payroll, benefits and expenses is not a requirement of an audit, particularly as the audit concept of an error being ‘material’ does not apply in tax. Employers should not therefore assume that a lack of comment from their auditors or accountants means that their PAYE procedures are in order.

Employers may wish to arrange for their tax advisor to undertake a PAYE health check (essentially mirroring an HMRC review). This check is a comprehensive review of a business’ policies and procedures to ensure it is delivering the correct results in terms of compliance with HMRC. A review will highlight any areas of concern (in terms of both risks and opportunities) and provide practical recommendations for actions required to move forward. If this is something that would be of interest, please contact us at info@thomsoncooper.com.

Keith Hunter is a Senior Tax Manager with Thomson Cooper Accountants. He specialises in personal and employment taxes and is a Chartered Tax Advisor (CTA). Keith has previous experience as an Officer with HM Revenue & Customs where he was involved in various aspects of PAYE and Self-Assessment.